Cigarette Taxes And Cigarette Smuggling By State

” Public policies often have unintended consequences that outweigh their benefits. One consequence of high state cigarette tax rates has been increased smuggling as criminals procure discounted packs from low-tax states to sell in high-tax states. Growing cigarette tax differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

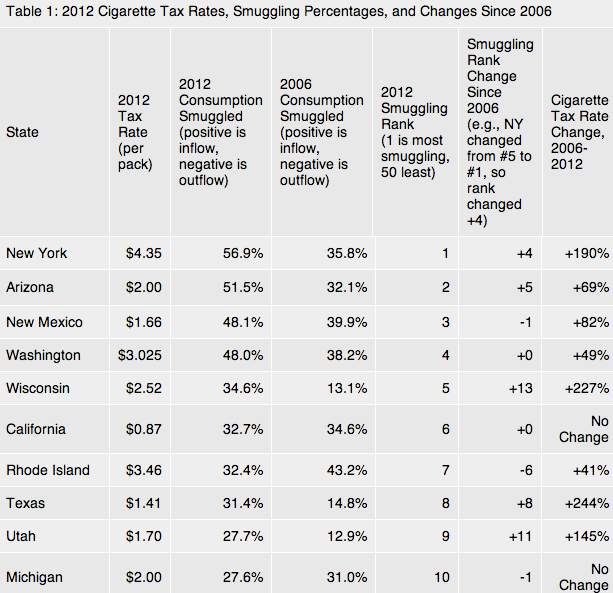

Each year, scholars at the Mackinac Center for Public Policy, a Michigan think tank, use a statistical analysis of available data to estimate smuggling rates for each state.[1] Their most recent report uses 2012 data and finds that smuggling rates generally rise in states after they adopt large cigarette tax increases. Smuggling rates have dropped in some states, however, often where neighboring states have higher cigarette tax rates. Table 1 shows the data for each state, comparing 2012 and 2006 smuggling rates and tax changes.”

” New York is the highest net importer of smuggled cigarettes, totaling 56.9 percent of the total cigarette market in the state. New York also has the highest state cigarette tax ($4.35 per pack), not counting the local New York City cigarette tax (an additional $1.50 per pack). Smuggling in New York has risen sharply since 2006 (+59 percent), as has the tax rate (+190 percent).”

Read the rest from the Tax Foundation

—

.png)